As the summer season approaches, those in the travel & tourism industries have a unique opportunity to capture and leverage visitor intelligence to drive marketing success in 2024-2025. Visitor intelligence can provide invaluable insights into customer behavior and preferences, allowing businesses to increase occupancy rates, drive engagement, and improve ROI on their ad spend.

Here we’ll explore some key points from McKinsey’s latest travel reports, The Way We Travel Now and The state of tourism and hospitality 2024, to discuss relevant travel trends and highlight how RMG’s visitor intelligence solutions can help you capitalize on these insights to achieve remarkable results.

Understanding Current Traveler Trends and Sentiments

McKinsey highlights demographic differences and trends across an international set of travelers to identify key takeaways to maximize their experiences and your business strategy.

Travel Priorities and Spending

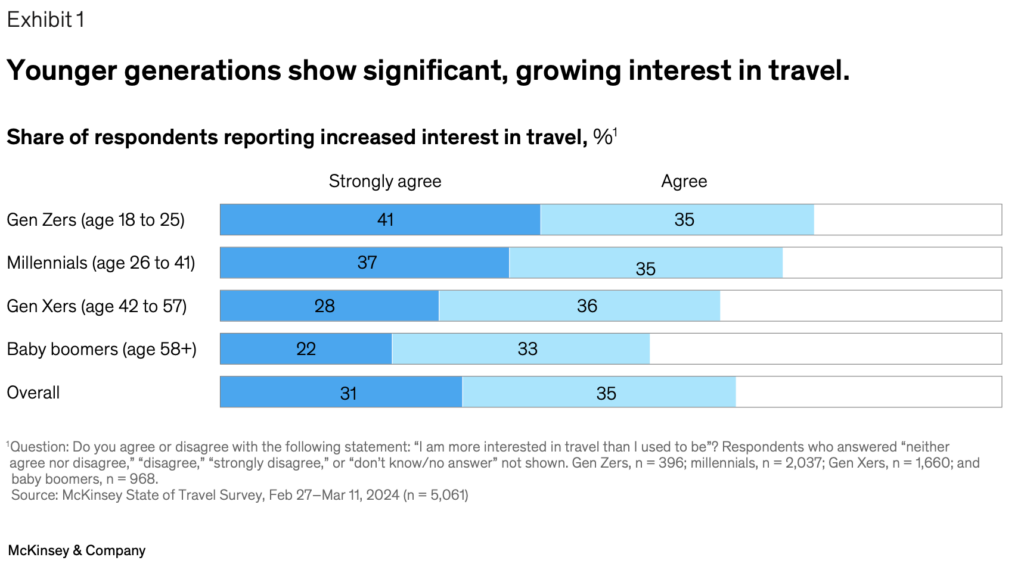

Travel has become a top priority for many, especially among younger generations. A survey conducted with over 5,000 travelers from China, Germany, the United Arab Emirates, the United Kingdom, and the United States revealed that 66% of travelers are more interested in travel now than they were before the COVID-19 pandemic. Despite economic uncertainties, travel continues to be one of the fastest-growing consumer spending areas, with a 6% increase over a recent 12-month period in the United States, even when adjusted for inflation. This trend is driven largely by millennials and Gen Zers, who took nearly five trips on average in 2023 and devoted a significant portion of their income to travel.

Generational Differences in Travel Preferences

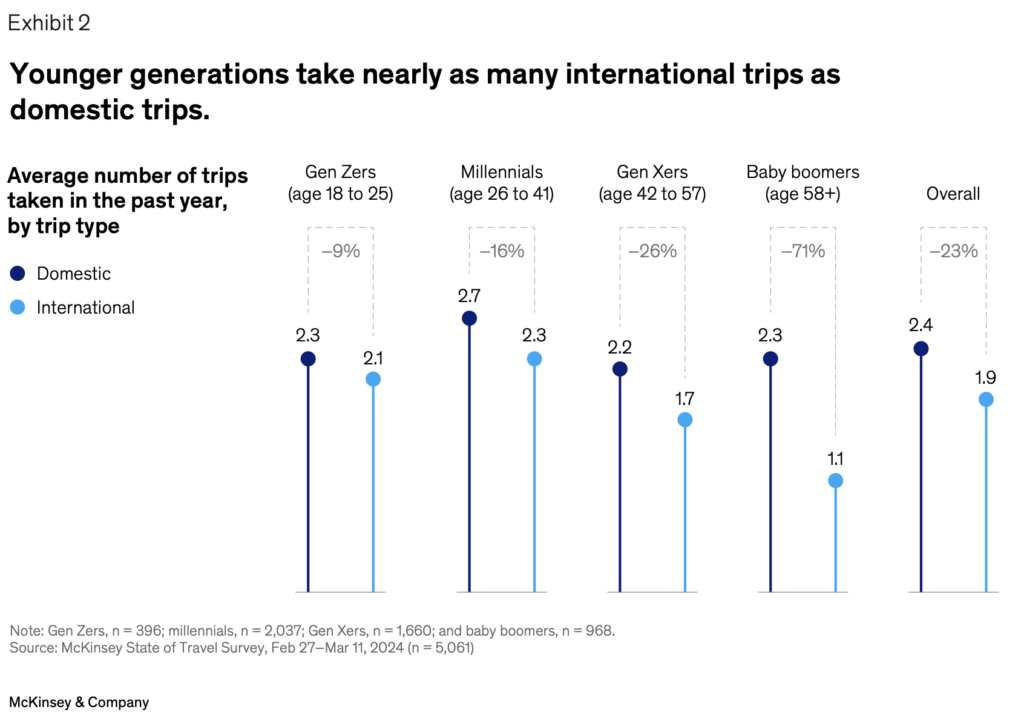

Younger generations are particularly keen on international travel, driven by their thirst for novelty and adventure. Gen Zers and millennials plan nearly equal numbers of international and domestic trips, whereas older generations tend to favor domestic travel. Younger travelers are adept at finding affordable international destinations and leveraging low-cost airlines, translation software, and mobile connectivity to make their travels more accessible and enjoyable.

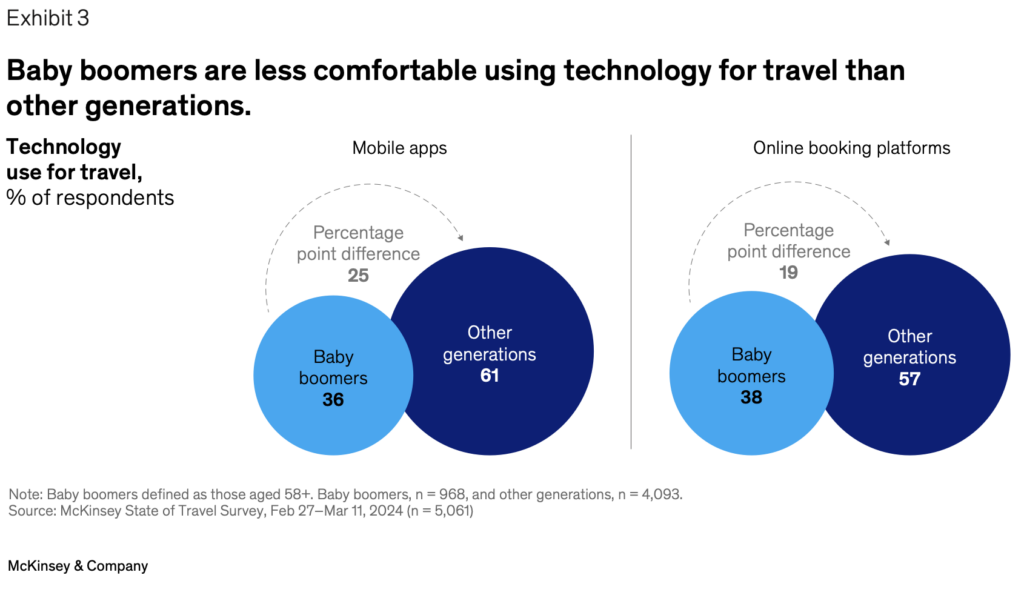

In contrast, baby boomers prioritize spending time with family and friends and are selective about their travel choices. They appreciate the convenience of technology but still value human contact in many contexts, such as booking travel through agents. While they may be willing to spend on travel, they do so strategically, seeking value and avoiding unnecessary splurges.

Planning Is Part of the Adventure

Across all travelers, the use of travel agents is down as people enjoy crafting their own itineraries. In fact, studies have shown that the anticipation of a journey can lead to higher levels of happiness than the journey itself (Jeroen Nawijn et al., “Vacationers happier, but most not happier after a holiday,” Applied Research in Quality of Life, March 2010, Volume 5, Number 1). Interestingly, despite other generational differences all demographics report looking for “value for money” as the key factor in their planning.

Emerging Traveler Archetypes

The survey identified seven distinct traveler archetypes based on shared attitudes and motivations:

- Sun and Beach Travelers (23%): Prefer relaxing, family-oriented vacations and value nonstop flights.

- Culture and Authenticity Seekers (18%): High-budget travelers who prioritize unique, immersive experiences over typical tourist destinations.

- Strategic Spenders (14%): Balance spending on authentic experiences with cost-saving measures.

- Trend-Conscious Jet-Setters (14%): High-budget travelers influenced by social media and brand popularity.

- Cost-Conscious Travelers (11%): Predominantly older travelers who prioritize familiarity and cost over new experiences.

- Premium Travelers (12%): Seek high-quality accommodations and experiences, less concerned with cost.

- Adventure Seekers (8%): Younger travelers who enjoy active holidays and meeting like-minded individuals.

Regional Travel Preferences

Travel preferences vary significantly by region. For instance, Chinese and Emirati travelers favor iconic destinations and shopping, while European and North American travelers seek to escape daily routines and enjoy beach getaways. Understanding these regional differences can help businesses tailor their offerings to meet the specific needs and desires of their target audiences.

Travel Tells a Story

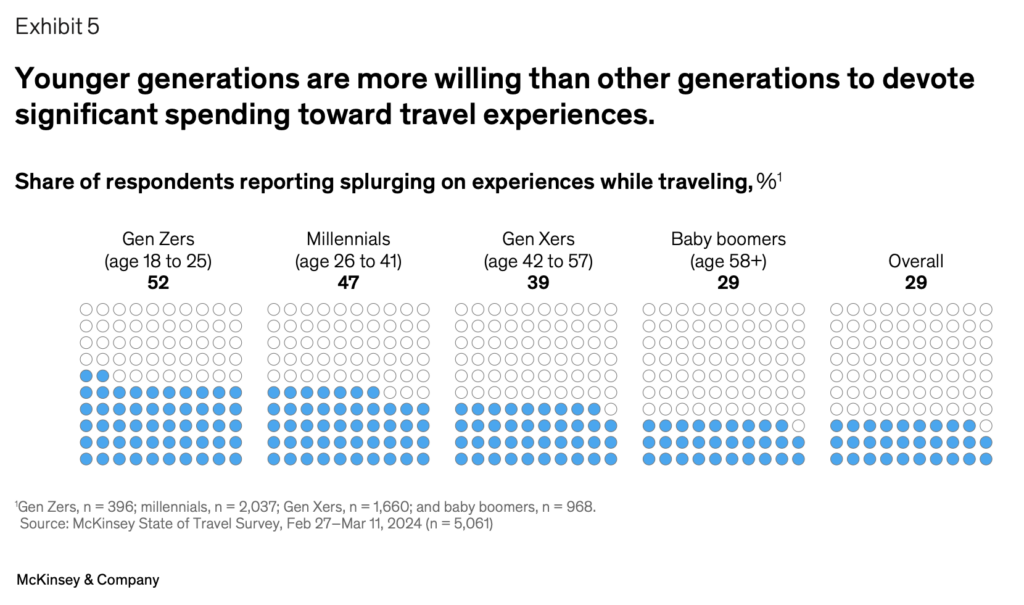

Younger generations are prioritizing experiences over possessions, with 52% of Gen Z travelers splurging on experiences compared to only 29% of baby boomers. Gen Zers prefer to save money on flights, local transportation, shopping, and food rather than cutting back on experiences.

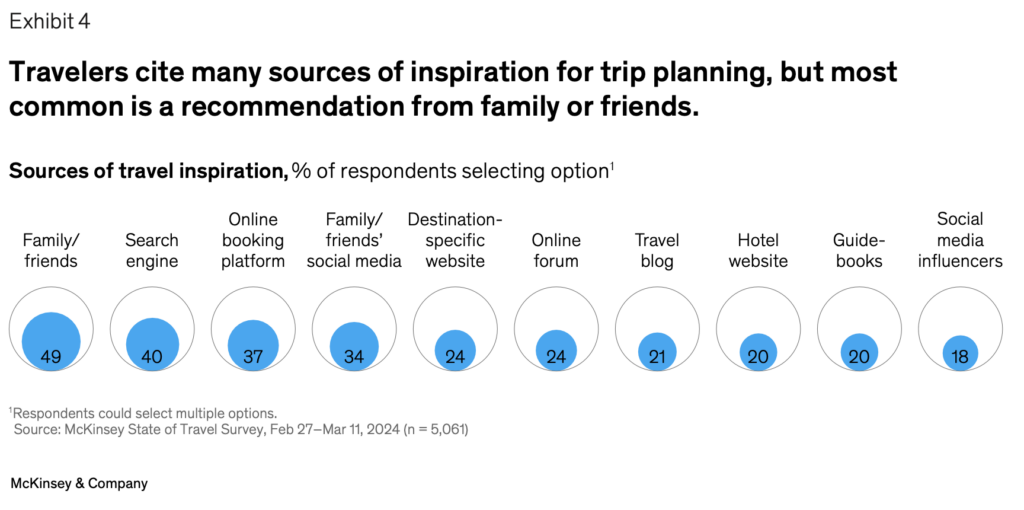

Social media plays a significant role in inspiring their travels, with 92% of younger travelers saying their last trip was influenced by social media, particularly by friends and family rather than celebrities. This generation values sharing their travel stories, and platforms like Polarsteps help them document and share their journeys in more detailed and enduring ways.

Serving Today’s Travelers

Overall, today’s travelers seek creative, tailored experiences that align with their personal narratives. By leveraging new technologies and focusing on personalized service, providers can meet these evolving needs and enhance customer satisfaction.

Personalize

To effectively engage today’s travelers, tourism industry players must move beyond one-size-fits-all experiences. Data segmentation can help identify specific customer segments, allowing for tailored approaches that better meet individual needs. Simple strategies like look-alike analysis and hypothesis-driven testing can provide significant insights without requiring advanced data strategies. RMG can help analyze your clientele and provide strategic recommendations to get started.

Personalization doesn’t need to focus solely on individuals. By understanding broader segments, such as families interested in outdoor activities, providers can craft compelling offers. Additionally, facilitating unique experiences like home-cooked meals with locals can enhance traveler satisfaction.

Support Storytelling

Travelers today also want to share their stories. Hotels can encourage this by providing photo booths, souvenirs, and anniversary trip photos. Engaging customers through social media, contests, and shareable promo codes can turn them into effective marketers.

Craft Affordable Experiences

Younger travelers’ desire for experiences often exceeds their budgets, creating an opportunity for providers to offer modern, affordable accommodations and activities. Providing alternative activities and accommodations, like outdoor fitness classes instead of luxury spa packages, can entice younger travelers. Even a new spin on a classic can be appealing, such as a street art walking tour of Paris over an Eiffel Tower tour.

Human-Centered & Family-Friendly

Older travelers, while increasingly tech-savvy, still prefer human interaction. Tourism providers can cater to this by maintaining in-person visitor centers and personal touchpoints. By tracking guest preferences and historical behavior, such as favorite meals or regular visits to specific locations, providers can offer personalized experiences and targeted offers. Having an up-to-date CRM with key dates, such as anniversaries and birthdays, can also go a long way with this demographic. RMG can help you clean up and maximize your CRM’s effectiveness.

Leveraging off-season travel patterns, providers can create appealing packages, like autumn wellness retreats. Additionally, offering multi-generational activities can attract older travelers who often visit family and friends, enhancing their travel experiences and encouraging repeat business.

The Future of Tourism and Hospitality

The state of tourism and hospitality 2024

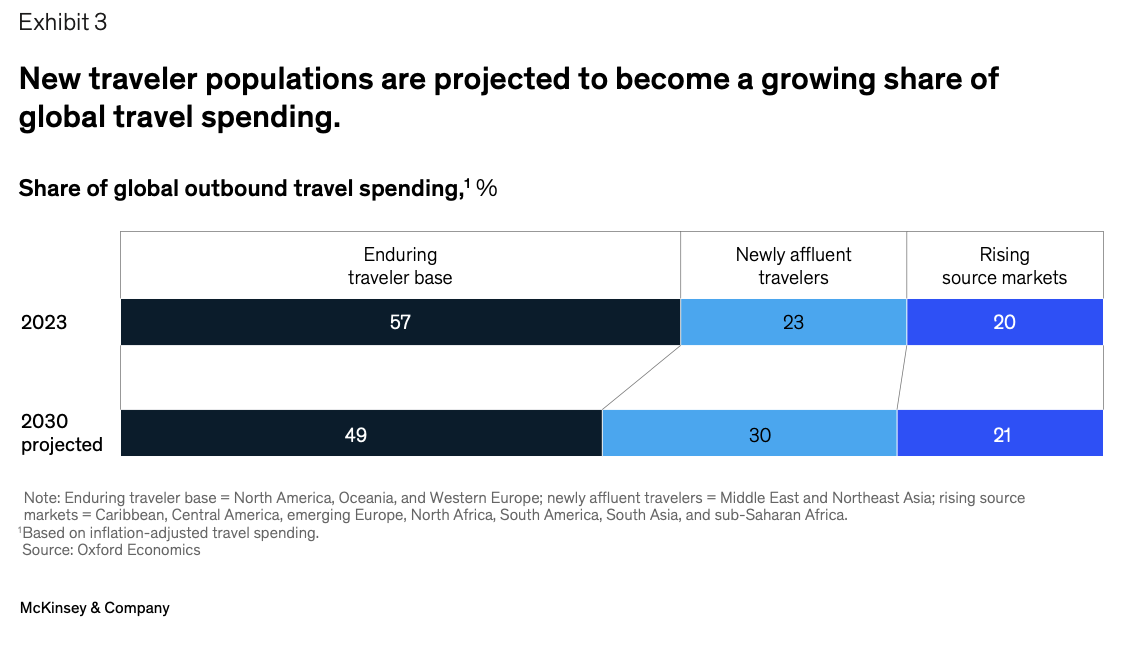

McKinsey predicts a boon in tourism and hospitality driven by new travelers, destinations, and trends. The industry is on track to fully recover by the end of 2024 following the pandemic.

Domestic and Intraregional Travel

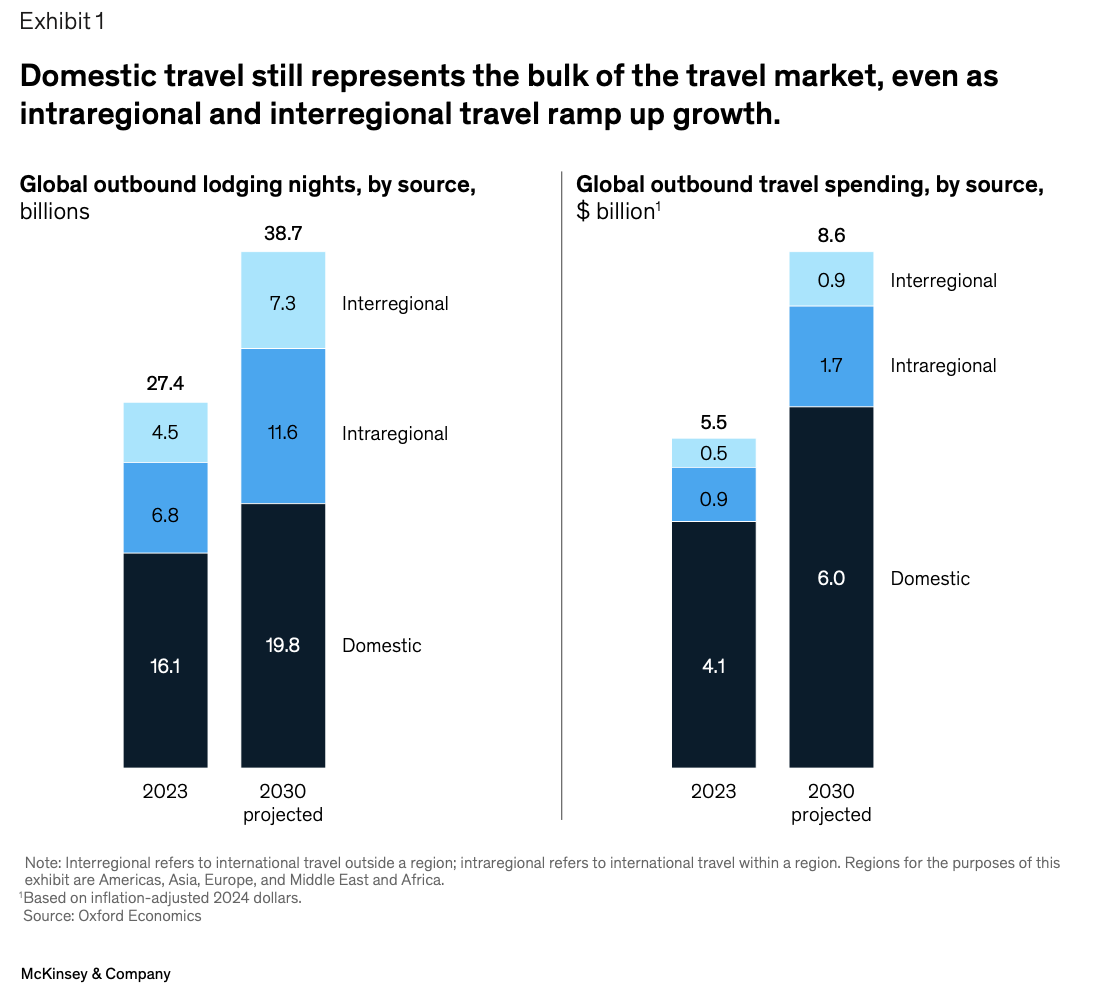

Despite the allure of international travel, domestic and intraregional travel represent significant opportunities. Domestic travel remains the bulk of travel spending, and intraregional tourism is on the rise. Businesses should not neglect these markets and should consider strategies to attract local travelers. Three key themes to consider:

- Most travel is close to home. Focus on your local markets and nearby countries.

- Top source markets are evolving. Eastern Europe, India, and Southeast Asia are becoming major outbound tourism segments.

- New destinations alongside old. Locations off the beaten path, or long forgotten, are finding ways to attract travelers and join popular locations across itineraries.

Download the full report to explore additional visualizations and information.

Personalization and Segmentation

Today’s travelers demand personalized experiences. While individual personalization may not always be practical, businesses can use data segmentation and hypothesis-driven testing to tailor their offerings to specific customer segments. Failure to adapt to these changing preferences can result in lost opportunities. RMG can help analyze your clientele and provide strategic recommendations to get started.

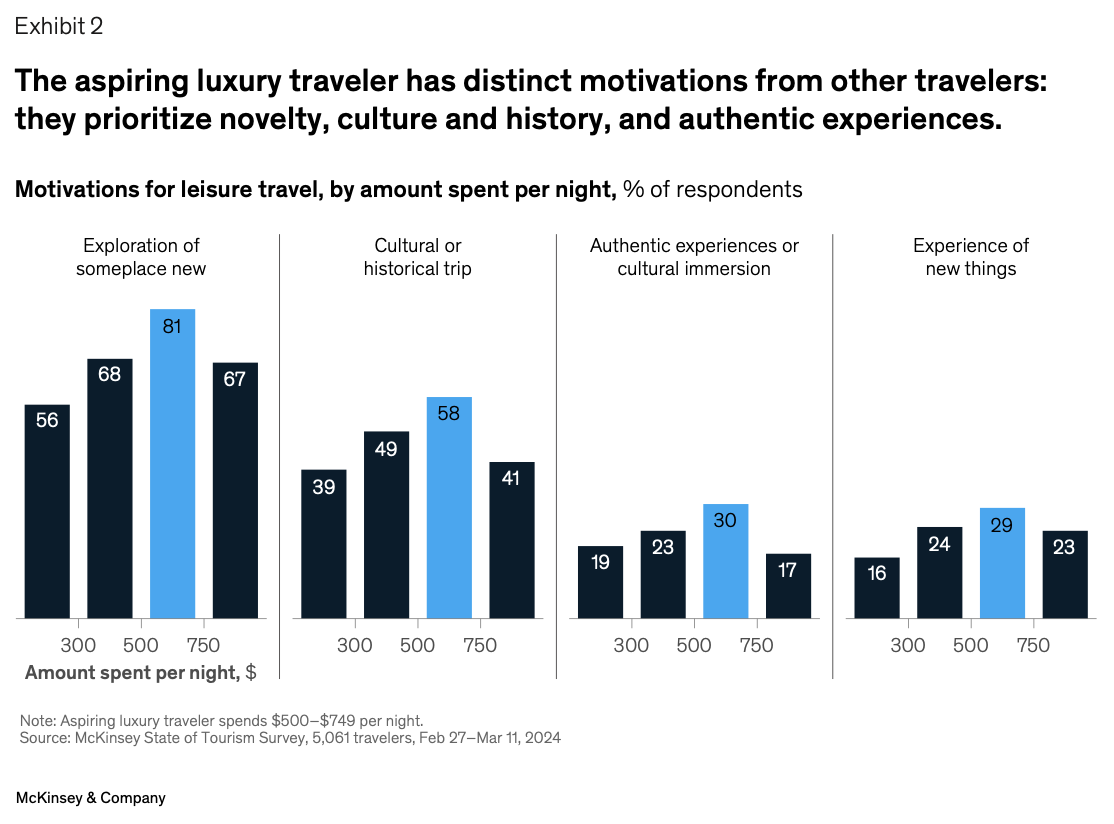

Evolving Luxury Travel

Luxury travel is expected to grow faster than any other travel segment, particularly in Asia. However, luxury travelers are not a monolith. Segmenting this group by age, nationality, and net worth can reveal diverse preferences and behaviors. Understanding these nuances is crucial for businesses aiming to cater to luxury travelers effectively.

Wealth

Luxury travel is no longer just for millionaires, with 35% of the market now comprising travelers worth between $100,000 and $1 million. High-net-worth individuals seek privacy and exclusivity through boutique agents, while ultrahigh-net-worth individuals prefer remote, personalized luxury experiences. Aspiring luxury travelers, a significant and growing segment, value branded luxury, special occasions, and loyalty benefits, presenting opportunities for brands to attract their loyalty and cater to their evolving preferences.

Geography

The geographical balance of wealth is shifting, with Asia, particularly China, expected to overtake North America in the number of millionaires by the mid-2030s. This rapid wealth growth is driving a boom in regional luxury hotel construction, with 41% of the global luxury-hotel pipeline in Asia, reflecting Asian travelers’ preference for trusted luxury brands and larger properties.

Age

While baby boomers represent significant luxury spending, 80% of the luxury leisure market comprises individuals under 60, with spending peaking between ages 40 and 60. Luxury providers should cater to middle-aged travelers, including families and multigenerational groups, and also target younger travelers by focusing on social experiences, authenticity, sustainability, and digital connectedness to build long-term customer relationships.

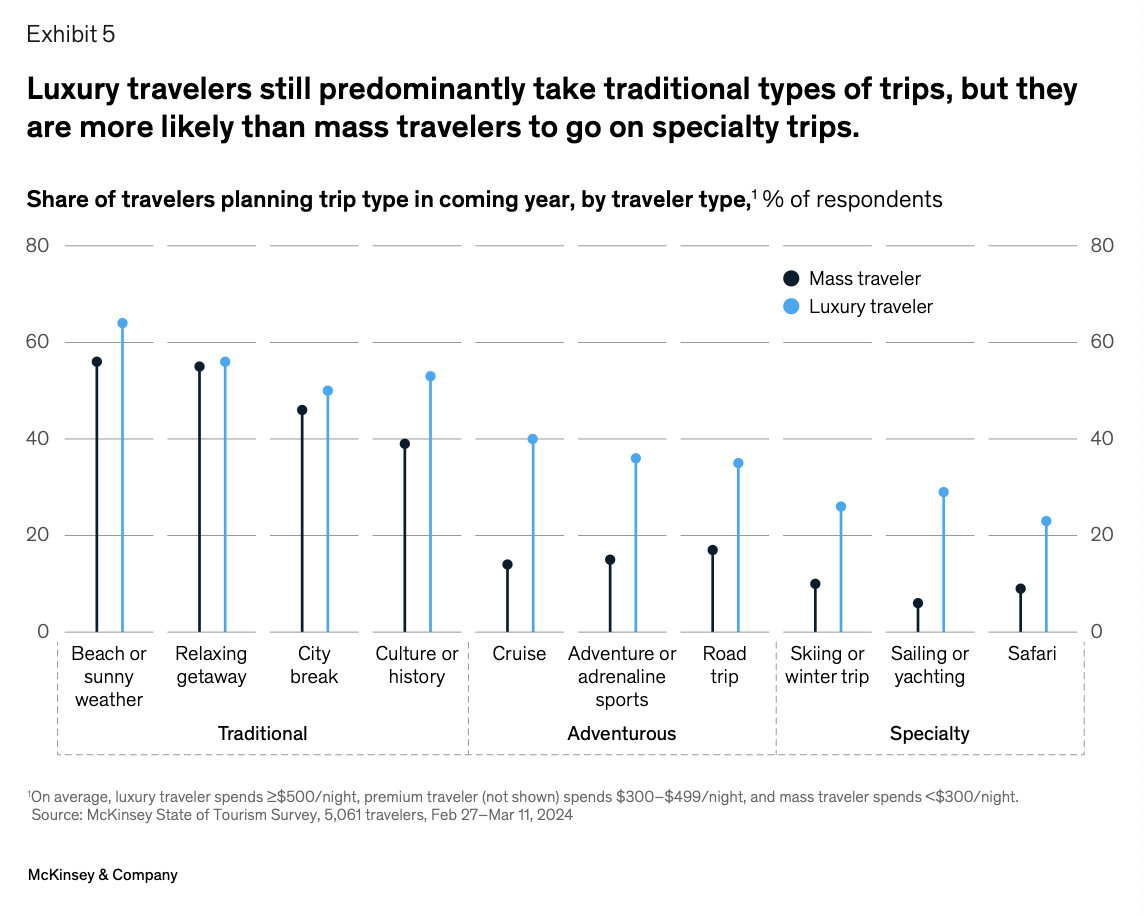

Experiences

While luxury travelers enjoy exotic and adventure-focused vacations, the majority still prefer typical activities like sunny beach vacations and relaxing getaways. However, they seek novelty in new destinations, suggesting opportunities for developing new luxury destinations or refreshing traditional ones with upgraded accommodations and unique experiences to attract frequent visitors.

Digital Connection

While luxury travelers value digital connectivity, they are two to three times more likely than mass travelers to prioritize meeting new people and disconnecting from devices. This highlights the demand for small-group travel experiences and suggests that luxury providers should create inviting spaces for digital disconnection, such as common eating areas and shared tables.

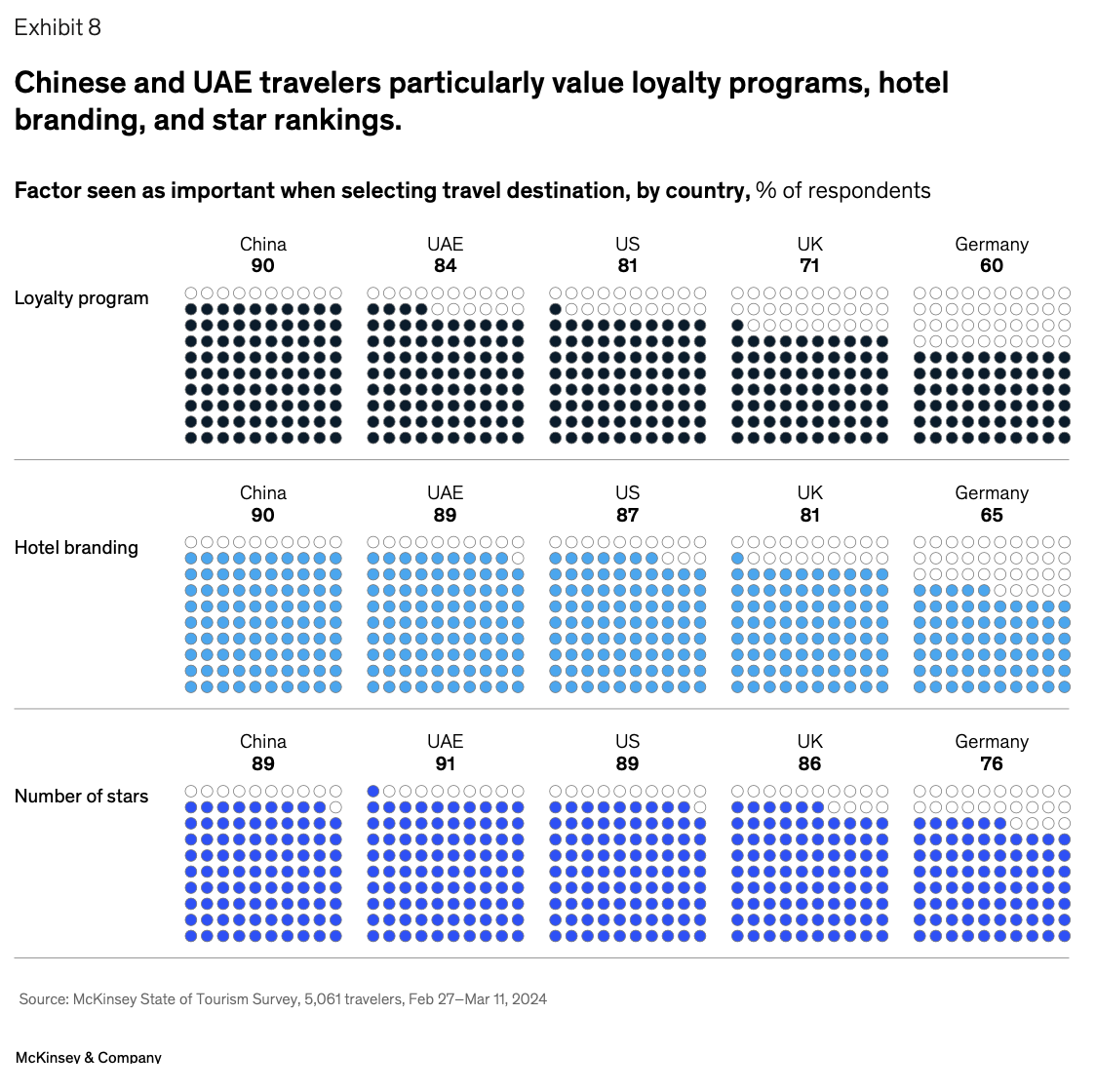

Loyalty

Luxury travelers highly value hotel loyalty programs, with 68% considering them important when choosing accommodations, compared to 41% of mass travelers. They prioritize the recognition and exclusive privileges that come with loyalty programs, as well as the reputation and quality assurance communicated by hotel brands and star rankings.

Resorts

Luxury travelers appreciate the ease and variety of all-inclusive resorts but seek exclusive offerings and personalization. Resorts can attract this market by providing dedicated concierge services, customized dining options, and adventurous experiences, while using data to offer personalized touches such as tracking dietary preferences and inscribing guests’ nicknames on their slippers.

Luxury at Scale

Historically associated with independently owned hotels, the luxury segment has seen successful scaling by brands like Four Seasons and Mandarin Oriental. Major groups like Leading Hotels of the World have unified independent luxury hotels, offering quality at scale and providing strength in numbers. While 70% of current luxury hotels are independent, 78% of planned properties are chain or franchise, highlighting the trend towards larger, branded luxury hotels. These brands must balance scale with personalized, high-touch service, potentially through exclusive offerings like luxury villas adjacent to larger properties.

Agents

Luxury travel inspiration now primarily comes from social networks rather than travel agents, but travel advisors still play a crucial role. Many luxury travelers prefer advisors for personalized service and handling transactional details, facilitated by technology and data, while also desiring 24/7 concierge services and membership benefits from subscription-based travel clubs.

Wellness

Luxury travelers are increasingly prioritizing wellness in their travel experiences, seeking holistic health offerings beyond traditional spa treatments, such as fitness classes, health-focused menus, and cultural wellness practices. Emerging wellness hotels like SHA Wellness Clinic and 1 Hotel Hanalei Bay cater to these demands with specialized programs and comprehensive wellness facilities, indicating a growing market trend towards transformative and integrated wellness experiences in luxury travel.

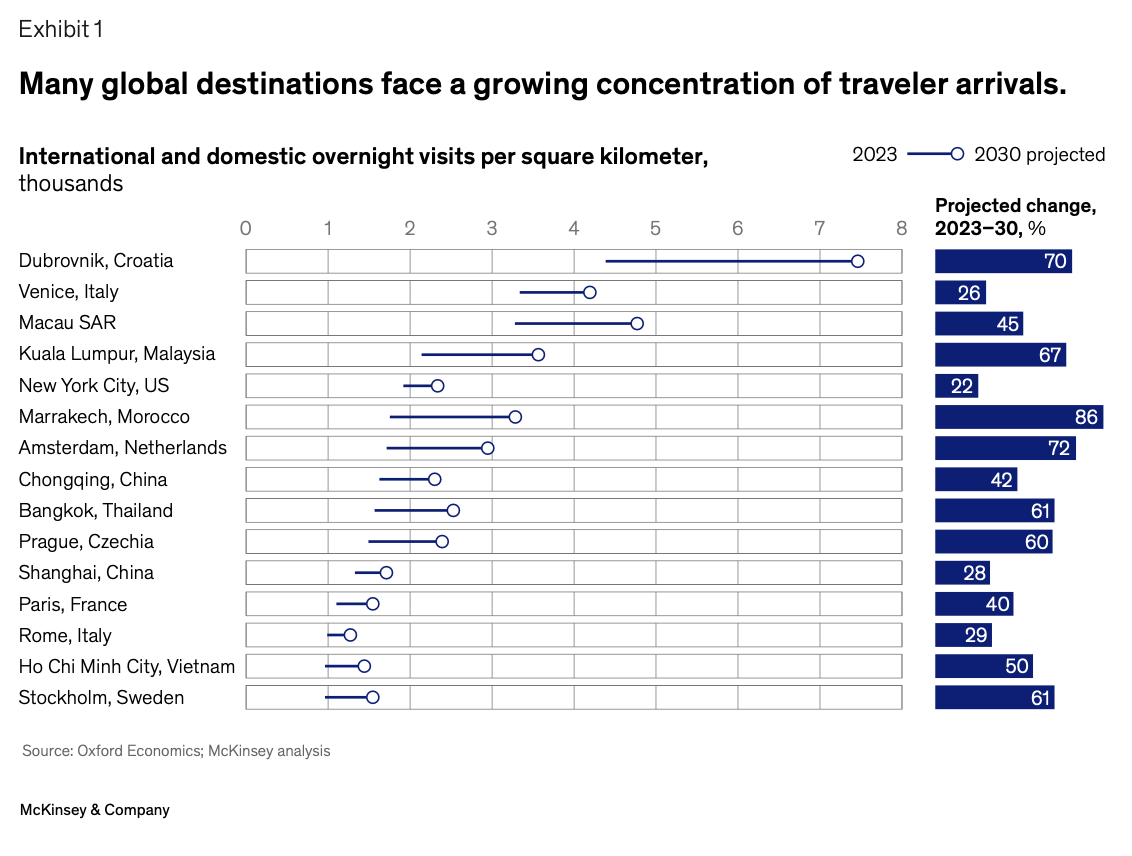

Managing Tourist Flows and Mitigating Overcrowding

As tourism grows, destinations must prepare to manage large tourist flows to avoid overcrowding. This involves developing infrastructure, enhancing transportation, building a tourism-ready workforce, and preserving natural and cultural heritage. Accurate data and assessments of carrying capacities are essential for effective planning and investment.

Carrying capacity in tourism refers to the maximum sustainable number of visitors a destination can handle without detrimental effects on its environment and community. Effective management involves understanding these limits and implementing strategies to stay within them. Exceeding carrying capacity can lead to negative impacts that outweigh the benefits of tourism, necessitating proactive measures to enhance capacity management. Tools like McKinsey’s diagnostic tool help identify early warning signs of stress in destinations, categorizing them into archetypes based on visitor flow and management capabilities. These categories—seasonally overloaded, increasingly stressed, actively managed, and balanced-capacity—guide destinations in developing appropriate strategies to sustainably accommodate and manage tourism growth while preserving local assets and quality of life.

McKinsey lists several strategies for funding destination readiness:

- Create permit systems for individual attractions

- Leverage on major, one-off events

- Take advantage of public-private partnerships

- Invest proceeds from tourism where they are needed

To prepare for increasing tourist volumes, the tourism ecosystem should focus on strategies such as developing a skilled tourism workforce, utilizing data for managing visitor flows, targeting specific tourist segments, spatially and temporally spreading visitor traffic, preparing for unexpected fluctuations, and safeguarding cultural and natural heritage. Coordination among various stakeholders is crucial for effective implementation of these measures.

Tourism & Hospitality Trends

Over the past decade, tourism and hospitality companies have adapted to changing markets and evolved their business models, emphasizing asset-light accommodation strategies, consolidation for scale efficiencies, and a renewed focus on guest relationships. Meanwhile, in the experiences sector, innovation and demographic diversification have been key, presenting opportunities amidst fragmentation and legacy structures.

Looking ahead to the next decade, tourism and hospitality companies can sustain growth and profitability by implementing three key strategies.

First, adopting unbundled offerings similar to airlines allows hotels and experience providers to customize and charge for specific amenities or upgrades that guests value, potentially increasing both revenue and satisfaction.

Second, cross-selling exclusive experiences—such as combining accommodation with local attractions or services—enables companies to tap into new areas of traveler spending and deepen customer relationships as trip planners.

Lastly, embracing a data-powered strategy by leveraging insights from booking patterns, social media trends, and guest preferences allows stakeholders to innovate and create personalized, compelling experiences that enhance overall travel satisfaction and drive additional revenue streams. These strategies collectively position businesses to stay competitive and responsive to evolving traveler demands in the coming years.

Leveraging RMG Visitor Intelligence

RMG’s visitor intelligence solutions empower businesses to harness these insights and drive remarkable results. Here are a few examples of how our clients have benefited from our services:

- Identified Revenue Drivers: One client revolutionized their customer engagement with RMG insights, pinpointing segments driving 72% of revenue and boosting engagement by 10%.

- Increased Revenue: One client launched a multichannel campaign that generated $800K in just over 100 days, representing an 18% increase in revenue production.

- Enhanced Engagement: Another client drove $3MM in incremental revenue over eight months using a multichannel engagement strategy.

By leveraging RMG’s visitor intelligence, businesses can achieve similar results, enhancing their marketing strategies and improving ROI. Our solutions provide a comprehensive understanding of visitor behavior, enabling businesses to tailor their offerings to meet the unique needs of their target audiences.

Capture Insights This Summer

As the summer season approaches, now is the perfect time to consider a data-driven approach to your marketing. Whether you are in the hospitality, tourism, or any other industry, increased engagement and improved ROI are possible with RMG.

We help our customers deliver 20-30% improvement in ROMI and thereby 20-30% occupancy improvement which drives larger budgets and happier Board members. Schedule a call to see how we can help you, too.

Understanding current travel trends and leveraging visitor intelligence can provide significant benefits for businesses. By adapting to the evolving preferences of travelers and using data-driven strategies, businesses can increase engagement, enhance customer satisfaction, and drive revenue growth. RMG’s visitor intelligence solutions offer the insights and tools needed to succeed in this dynamic environment. Embrace the opportunity to elevate your marketing efforts and achieve new heights of success in 2024-2025.